The impact of COVID on global compliance

How the Global Pandemic Has Underscored the Need for E-Invoicing

In early 2020 Gartner said that within a decade 60% of countries will have implemented some form of fiscal regulation requiring e-invoicing; we expect more, increasingly diverse mandates on e-invoicing — much sooner.

As we explain in our whitepaper on rising accounts payable inefficiency (and what you can do to address it), “ineffective invoicing processes and inadequate reporting, resulting in frequent tax leakage and poor invoice monitoring” have created gaping gaps between expected and collected Value-Added Tax (VAT) revenue across the world.

This is why Italy, home to the largest VAT gap in the European Union, mandated the use of electronic invoicing back in January 2019, and many other countries across Europe, Latin America and Asia have done the same, aiming to address the inadequacies of paper-based invoice processing.

For many businesses, increasingly stringent and diverse state mandates have facilitated the expedition of their digital transformation; for others, these changes have led to massive noncompliance fines — even upwards of £380 million.

Now, with the global pandemic causing a drop in economic activity “without precedent in recent history,” governments are looking to take further, significant action to improve tax collection and prevent collapse.

As the European Commission explains, “It is more important than ever for Member States to have secure tax revenues, so they can invest in the people and businesses who need it most.”

The Commission’s new Tax Package, released on 15 July 2020, includes 25 initiatives to better adapt taxation to “our digital world” and mandates modernising VAT rules “to ensure they are fit for the online platform economy.”

For businesses, this will mean adapting, quickly, to the global tax policy responses to COVID-19.

Global Tax Policy Responses to COVID-19

Across the world, governments have responded to COVID-19 by acting “rapidly and forcefully to limit the economic hardship caused by lockdowns and other containment measures.” According to the Organisation for Economic Co-operation and Development (OECD), “While the size of fiscal packages has varied across countries, most have been significant, and some countries have taken unprecedented action.”

At Tungsten Network we’ve observed:

- More than 1,190 fiscal measures taken globally

- Significant fiscal packages implemented, mostly in phases as the crisis has unfolded

- 95% of countries acted to improve business cash flow, with 75% taking VAT-related measures

- Some tax reforms, such as e-invoicing mandates, have been delayed, as in Vietnam, while others, including in Greece and Egypt, have already been implemented

B2B Invoicing Models

To complicate compliance efforts by accounts payable and accounts receivable departments at multinational organisations, no two state mandates are exactly alike and governments are tasking AP and AR teams with adhering to a number of different approaches.

To date, we’ve seen the implementation of the following B2B invoicing models:

Post Audit (United Kingdom, Netherlands, Germany, Malaysia)

- Suppliers create tax invoices that are sent directly to the buyer

- Controls are established via periodic tax filings

- Invoices may be sample-audited later

Mandatory Centralised E-Invoicing (Italy, Turkey (e-Fatura))

- Suppliers are required to send tax invoices to a central government platform

- The government platform validates, approves and records the tax details

- Buyers are required to retrieve the tax invoice from the government platform

Invoice Data Registration with Required Electronic Format (Mexico NFe, Brazil CFDi, Turkey ((e-Aršiv))

- Suppliers are required to send a pre-formed invoice or invoice information to a government platform in a structured format

- The government platform validates and records the tax details, provides a unique confirmation/identification code and creates a tax invoice from the structured invoice information and code

- Suppliers send the tax invoice to buyers

Invoice Data Registration without Required Electronic Format (India, Greece, Argentina)

- Suppliers are required to send invoice information to a government platform, often in a structured format

- The government platform validates and records tax details, and provides a unique code

- Suppliers are required to embed the unique code in the tax invoice, in any format including paper or PDF

- Suppliers send the tax invoice to buyers

Forthcoming Regulations and the Future of Compliance

OECD is advising governments to “continue to use fiscal tools to provide support to affected businesses and households,” and maintain support measures “as long as needed to avoid scarring effects” and expedite recovery.

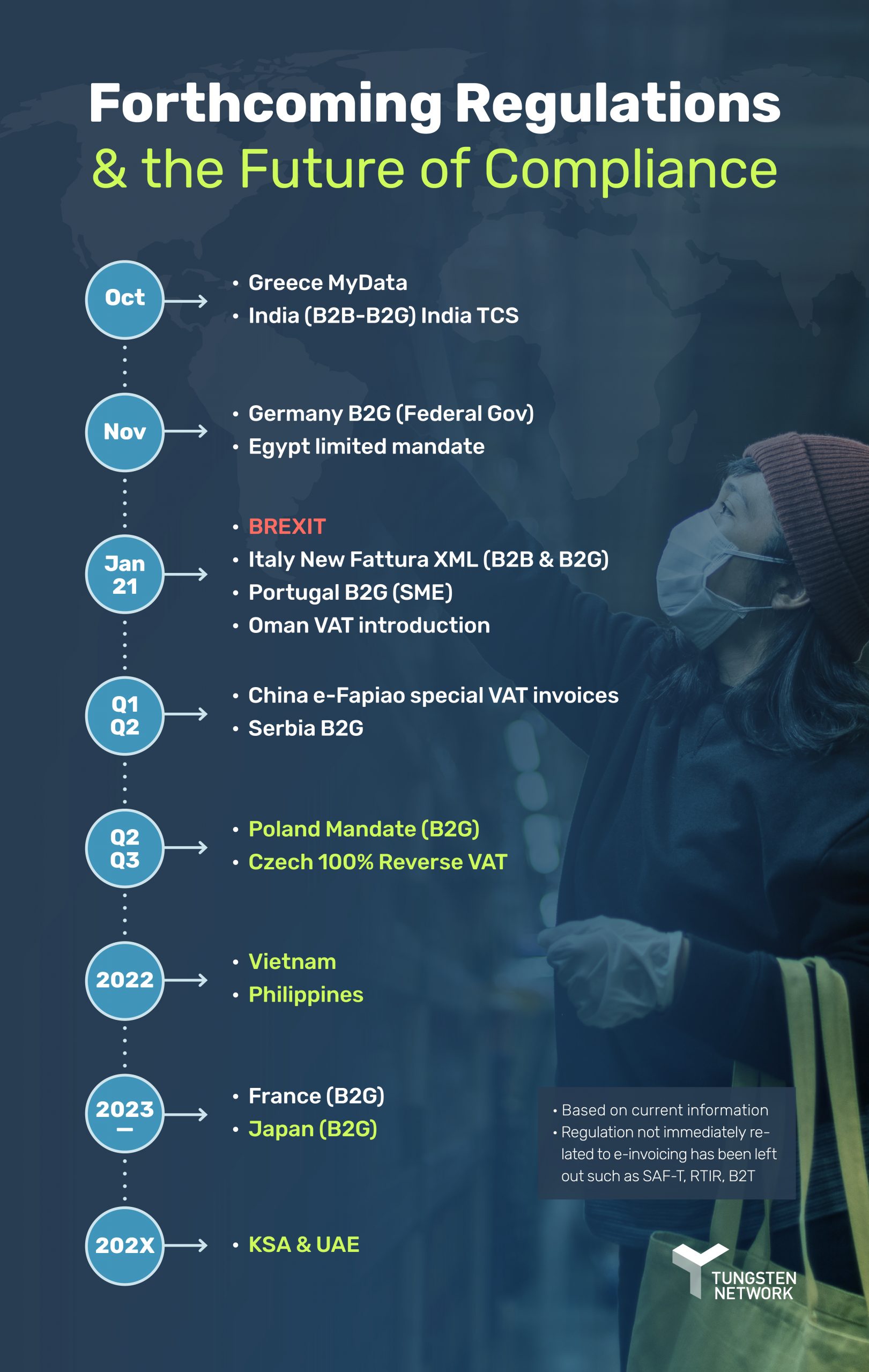

As a result, organisations that conduct business in countries that have not yet taken action should expect similar mandates, as illustrated in this timeline, and work proactively to ensure their compliance; world-class companies across the globe have reported benefits extending far beyond preventing fines and fees.

What You Can Do to Stay Compliant

There’s no debating that COVID-19 has ushered in a new normal, with governments working overtime to counteract the economic impacts of shutdowns and broken supply chains, but it has also shined a direct spotlight on the pre-existing inefficiencies of manual invoice processing.

By digitising your AP and AR processes, you can ensure your ongoing compliance with changing state mandates — and avoid potentially crippling fines and fees.

Plus, you’ll benefit from end-to-end process visibility, guaranteed invoice delivery, faster payments, improved customer relationships, secure archiving, and access to real-time, line-level analytics.

With Total AP from Tungsten Network, you upload your invoice to the platform for buyer review, processing and approval, and upon approval payment is sent — and you can accommodate all your suppliers, regardless of size, location or maturity.

With Total AR, you submit one file, through any channel, in any format, and deliver all your invoices to all your customers — and you can release cash to the balance sheet and gain business agility.

Further, with Tungsten Network’s white glove onboarding for your entire network the transition from manual to touchless will be smooth for you and your suppliers.

Find out how Total AP and Total AR from Tungsten can help you maintain compliance and deliver the agility your business needs to reach world-class status — during a global crisis and beyond.